As automotive manufacturers guide their fixed ops programs through rapid change, it’s often the case that no news about vendors is good news. The explosion of innovation that hit dealerships in the last several years – particularly since 2020 – makes managing technology implementation and optimization a daily challenge. And it shouldn’t be left unsaid that while every new system needs to work well at the dealership, it must also interface with the tools manufacturers use to monitor, measure and strategize on-the-ground activity.

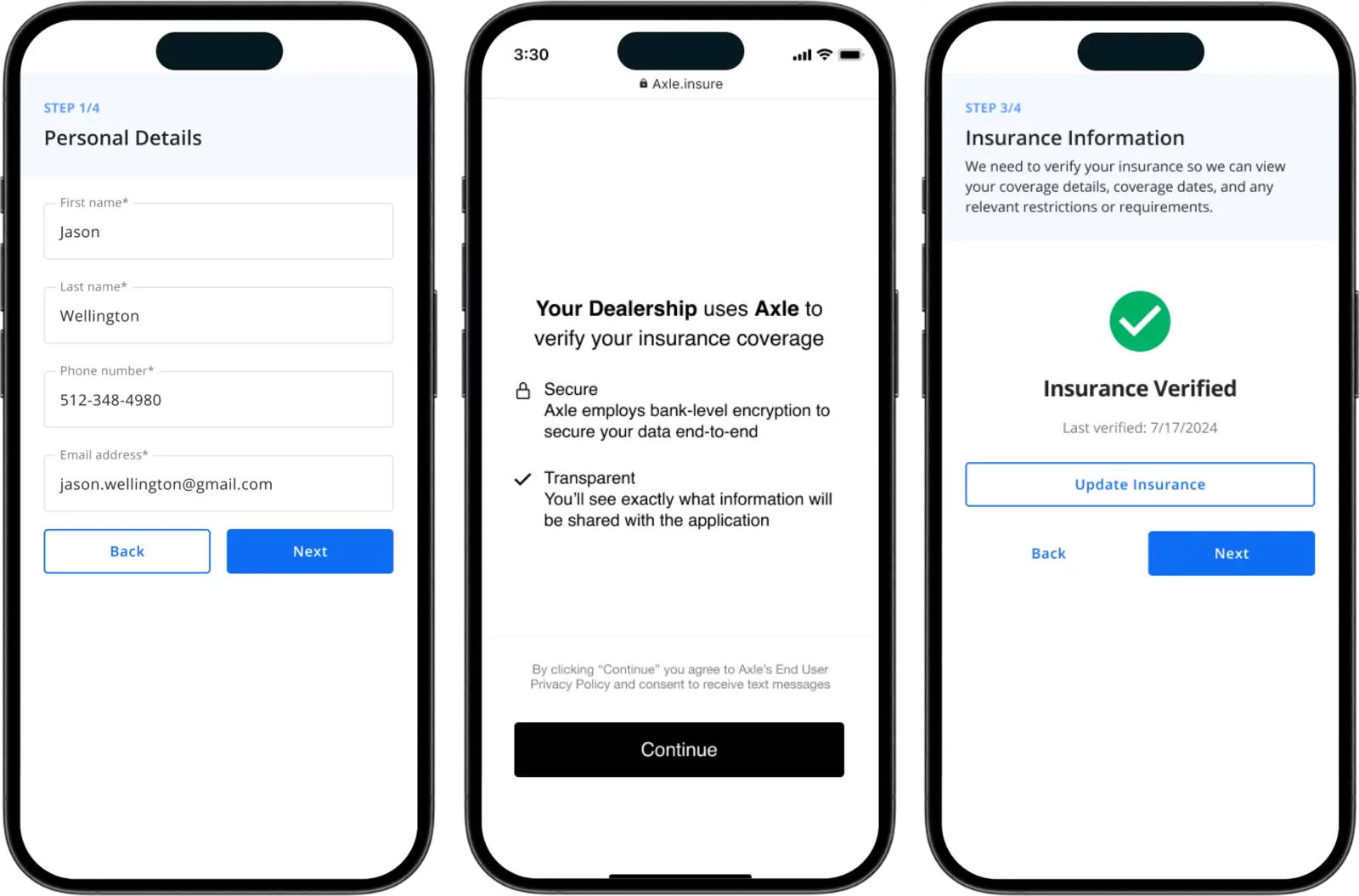

For one Dealerware customer overseeing aftersales technology programs for a major luxury manufacturer, recommending Dealerware to dealerships is a no-brainer because the platform is simple to implement and begin using. When everyone is trying new tools to combat old problems, having confidence that dealerships can quickly get comfortable with a technology platform is priceless.

“The feedback that I’ve had from retailers [about Dealerware] has been very strong and positive. Service managers have made comments to me about how Dealerware has improved the organization and logistics of their service loaner vehicles, and streamlined very old, antiquated paper processes into a quicker modern interface,” our OEM customer told us.

These improvements are helping dealership service departments become more self-sufficient in meeting or exceeding the OEM’s overall expectations for loaner fleet performance. Self-sufficiency at the dealership in turn means fewer calls for help from HQ, fewer headaches for individuals like the aftersales tech leader we spoke with, and more intelligent, efficient operations that can help service departments contribute more to their dealership’s bottom line.

Dealerware, in my opinion, for service loaner expenses, puts you ahead of the ball."

- OEM Aftersales Tech Leader

Power over expense uncertainty.

In times of uncertainty, padding the bottom line is priority number one. Current inventory shortages mean finding ways to increase fixed cost absorption is alchemy for dealerships.

Today, the average dealership covers only about 56% of their expenses through parts and service, while the NADA Academy says a 75% absorption rate makes for a very healthy and surprise-resistant business.

As a former fixed ops director himself, the aftersales tech leader we spoke with for this story said he recommends Dealerware because it helps dealerships track their costs and identify program performance issues when there’s still time to correct them.

“When it comes to service loaner expenses, you really don’t know how that hits you until the end of the month, because it’s all reactive expenses: Fuel; damage to the vehicle, it goes down the body shop and gets a bumper reworked; tires blown, so you’re putting a tire on, or four new tires. And you know, [without] Dealerware, you only see the cost of loaner car expenses when it’s too late.”

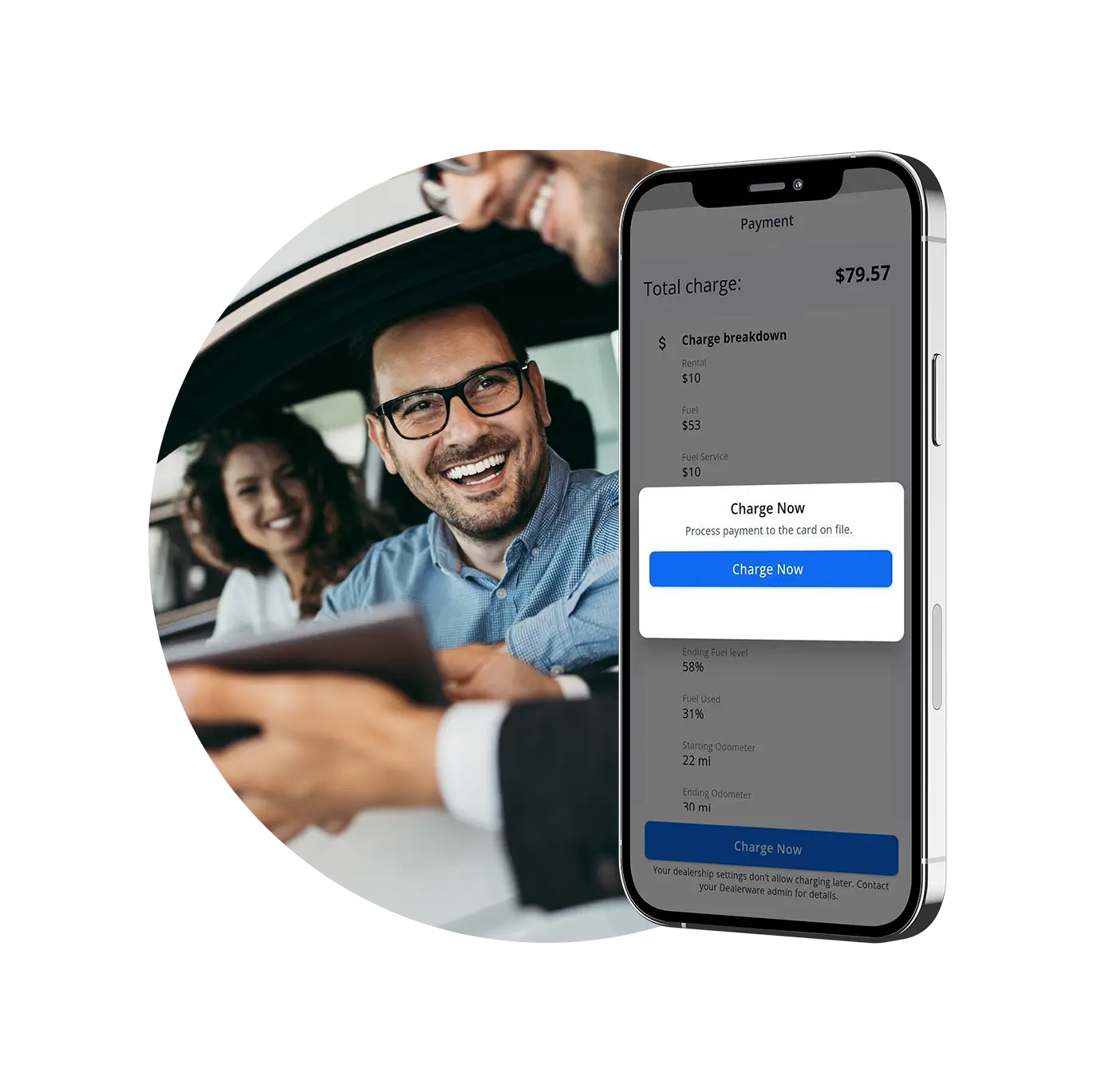

Loaner fleets should support higher RO volumes and help dealership fixed ops generate more revenue and absorb more of the business’ total expenses, but poorly-managed fleets, as our customer pointed out, can be a drain on fixed ops’ performance. Dealerware gives dealerships the power to automate the tracking and recovery of these costs, which can make a major impact on the value service departments get from their loaner fleet.

“For me, one of the common feedback items was that through fuel and toll collections, the cost of the software pays for itself. That right there should stop any service manager and say ‘yep, let’s sign up for it,’ and that’s just the beginning of it.”

Whether dealers didn’t know what they were spending before, or just accepted those costs as the price of doing business, Dealerware’s automation gives service managers control instead of being forced to react to costs. With Dealerware, service managers have a better way to benchmark the month-to-month performance of their fleet programs, and can use that information to see how ROs supported by loaners contribute to service absorption.

“The reporting to me is very, very critical for how much service loaners can really drain your bottom line.”

- OEM Aftersales Tech Leader

Plus, our OEM customer also highlighted that by helping service staff keep better track of vehicles and their readiness for the next contract, Dealerware is also an important tool for maximizing service department efficiency. Inventory crunches may be easing, but the challenges for loaner fleets remain the same: fewer fleet cars need to support repair order volume.

Supporting smarter management

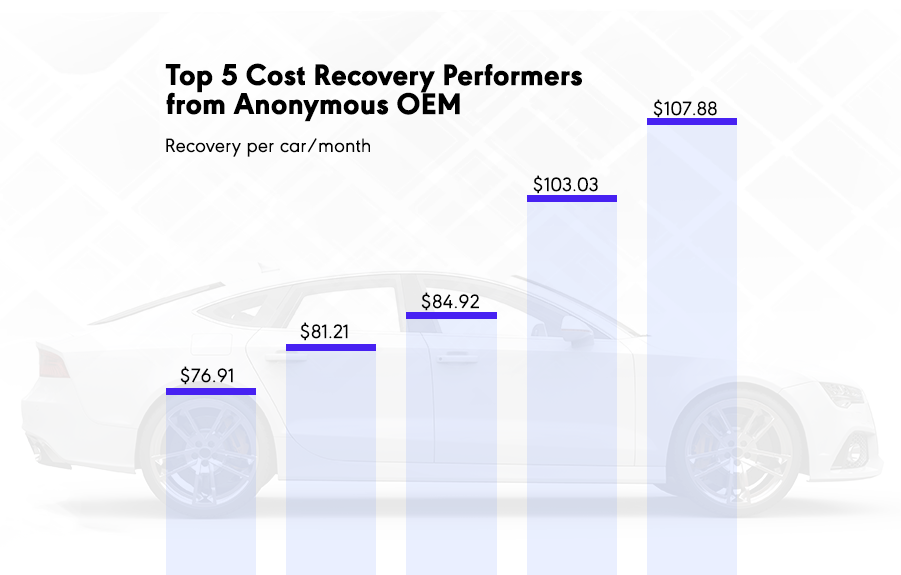

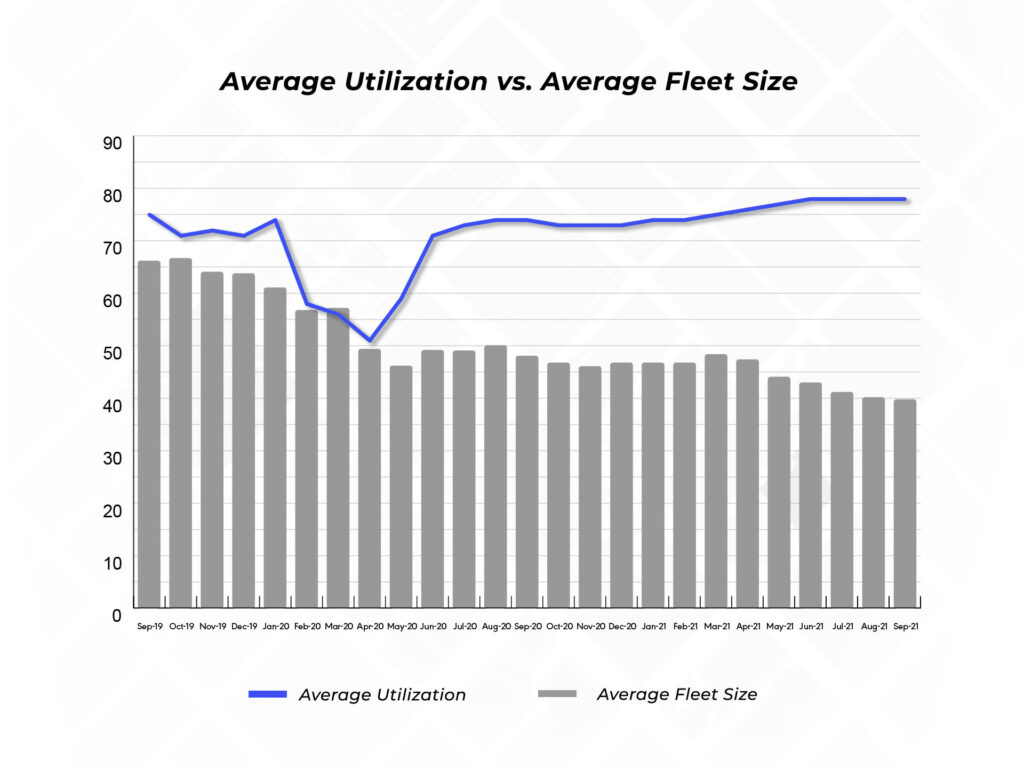

Dealerships that watch fleet data more closely should find that faster loaner turnarounds are the tip of the efficiency iceberg. The bigger piece of value is higher utilization across the whole fleet. On average, Dealerware helps service departments use their fleet 25% more, and our biggest utilization winners have even seen 40-50% increases in utilization.

“Through the reporting [in] Dealerware, [service managers] are able to manage their units and coach their service advisors in a much smarter and easier fashion,” said our luxury-brand aftersales tech leader.

The difference is evident, he said, when service managers request more vehicles from the factory to add to their loaner fleet. Decisions about fleet allocation are based on the same metrics that Dealerware makes it easy for service managers to track, so he tells field team members to remind service managers that Dealerware will help them make a better case for fleet allocations when they need more cars.

“It’s imperative, for the precious units they do have in loaner [fleets], that they’re maximizing those as best they can,” he said. If a store asks for more loaners, “provide me the reporting that shows your length of loan, your turnaround time, et cetera. Those metrics, they either support their case, or they don’t.”

So, what if they don’t? Improving operations and overall service department performance comes back to coaching service staff. Like our customer said, Dealerware gives managers the tools to identify issues and take a smarter approach with service advisors.

“You can see who is being aggressive and getting back a vehicle in two days… and then you can see those that are allowing customers to float an extra day, and their length of loan is longer than the other consultants.” With that reporting, he said, “I would be taking that service advisor in my office and saying ‘start stepping up and getting these cars back in,’ and laying out some action plans with that advisor to get them up to snuff with the rest of the team.”

Without a tool to track your fleet and team performance in real time, service managers again run up against problems of uncertainty, our customer said, whether the question is the source of costs or performance issues. “How are you going to prep and get your team to improve [after a month of sub-par performance]? Having no software, there’s absolutely no way that you can do it.”

No news is good news

We’ve shared plenty of stories over the years about our dealership customers’ experiences with Dealerware, but it’s less often that we have an opportunity to share opinions about Dealerware from the OEM teams managing loaner programs. Inevitably, our OEM customers are less involved in the day-to-day use of any technology, but recognize when they talk with dealership teams the impact that different tools have on the ground.

“With the 13 projects and programs that I’m managing right now, I mostly hear about stuff, unfortunately, when it hits the fan,” said the aftersales tech leader we spoke with for this story. “When it comes to improving service departments, they know to lean on providers to get ROI out of that software.”

Your churn rate has to be like, point zero-zero-one percent, right?”

- OEM Aftersales Tech Leader

“If they weren’t getting ROI, people would be leaving your software and going to something else, and that’s not the case, I mean, your churn rate has to be like .001 percent or something like that, “ he said. “It goes to show in your churn rate how good your product is, but also how your performance people, your support line, that if there is an issue with your software, it’s getting adjusted or fixed.”

When it comes to making sure our customers see the hard-numbers ROI we know Dealerware creates, or helping them use our data to improve staff performance or increase fleet utilization, we’re committed to being good partners, from the factory to the dealership service drive. Put another way: we’re customer obsessed.