The automotive industry is undoubtedly among the most affected by the Covid-19 pandemic. 2020 brought a lot of uncertainty, but as people get back on the road, the dueling impacts of supply chain issues and enormous demand has netted positive for automakers. However, dealerships find themselves caught in a tug-of-war between high demand and low inventory. If, as all signs indicate, recovery will take another full year, we’re looking at recent mobility trend data to see the silver lining for dealers.

The most obvious is a downturn in shared transit and a renewed appreciation for personal transportation. People are using public transportation less and opting out of ride-sharing services, such as Lyft and Uber. As CBT News recently wrote: “Americans have been more inclined to stick with mobility options that they can pilot themselves.”

This is a reversal of the trends of the last decade, where ride-sharing, car-sharing and vehicle subscriptions attracted a significant share of the mobility market. In the current pandemic economy, however, the safety and convenience of personal transportation seems to be reminding many younger consumers of the cost-effectiveness and practicality of owning your own car.

Americans have been more inclined to stick with mobility options that they can pilot themselves.

- CBT News

This is huge for dealerships who just last year had to close down for months and lay employees off to stay afloat. Vehicles are being bought and driven off the lot as quickly as they were driven on. With the increased desire Americans have to own their car, dealerships have several opportunities to increase profitability.

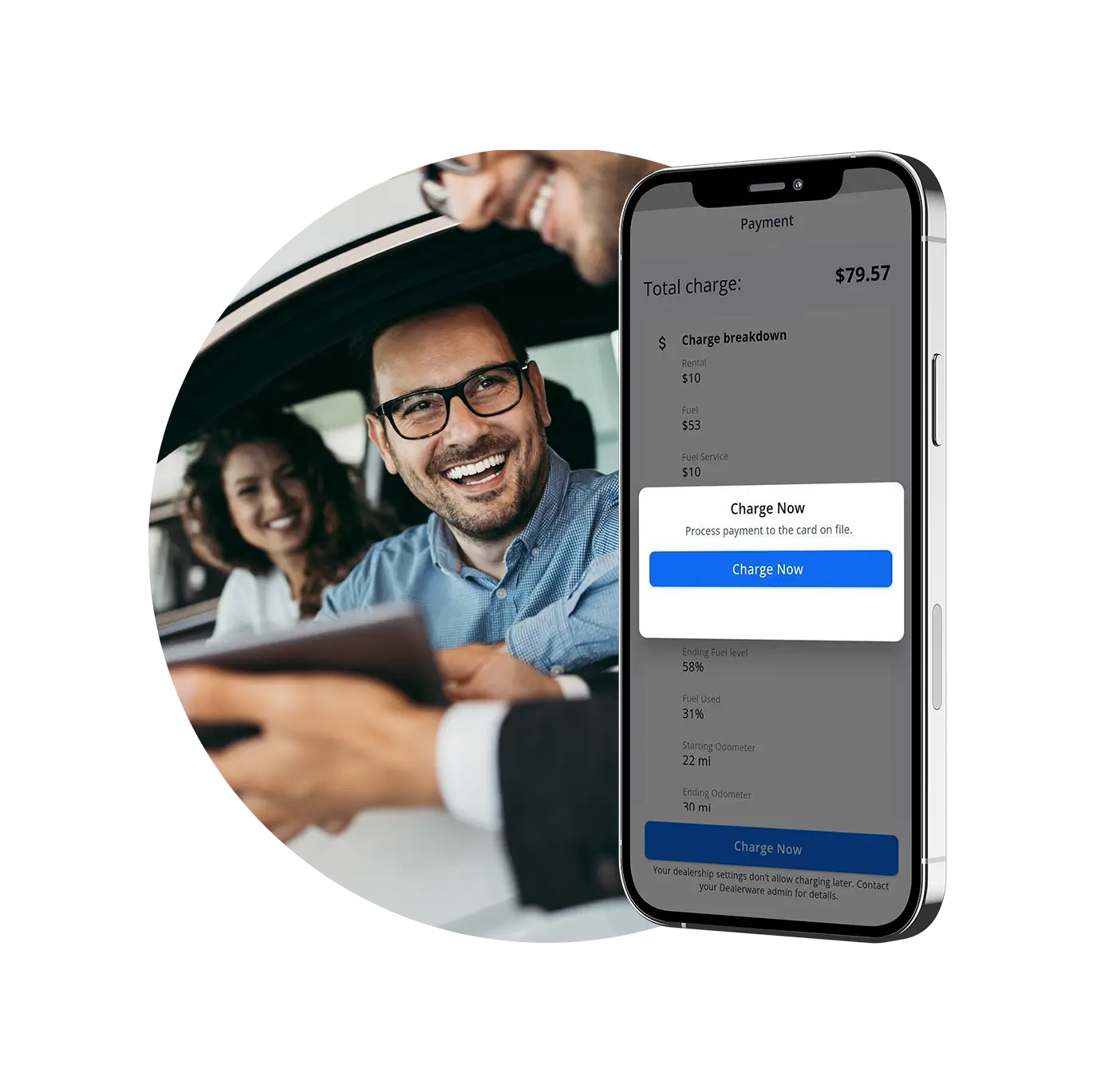

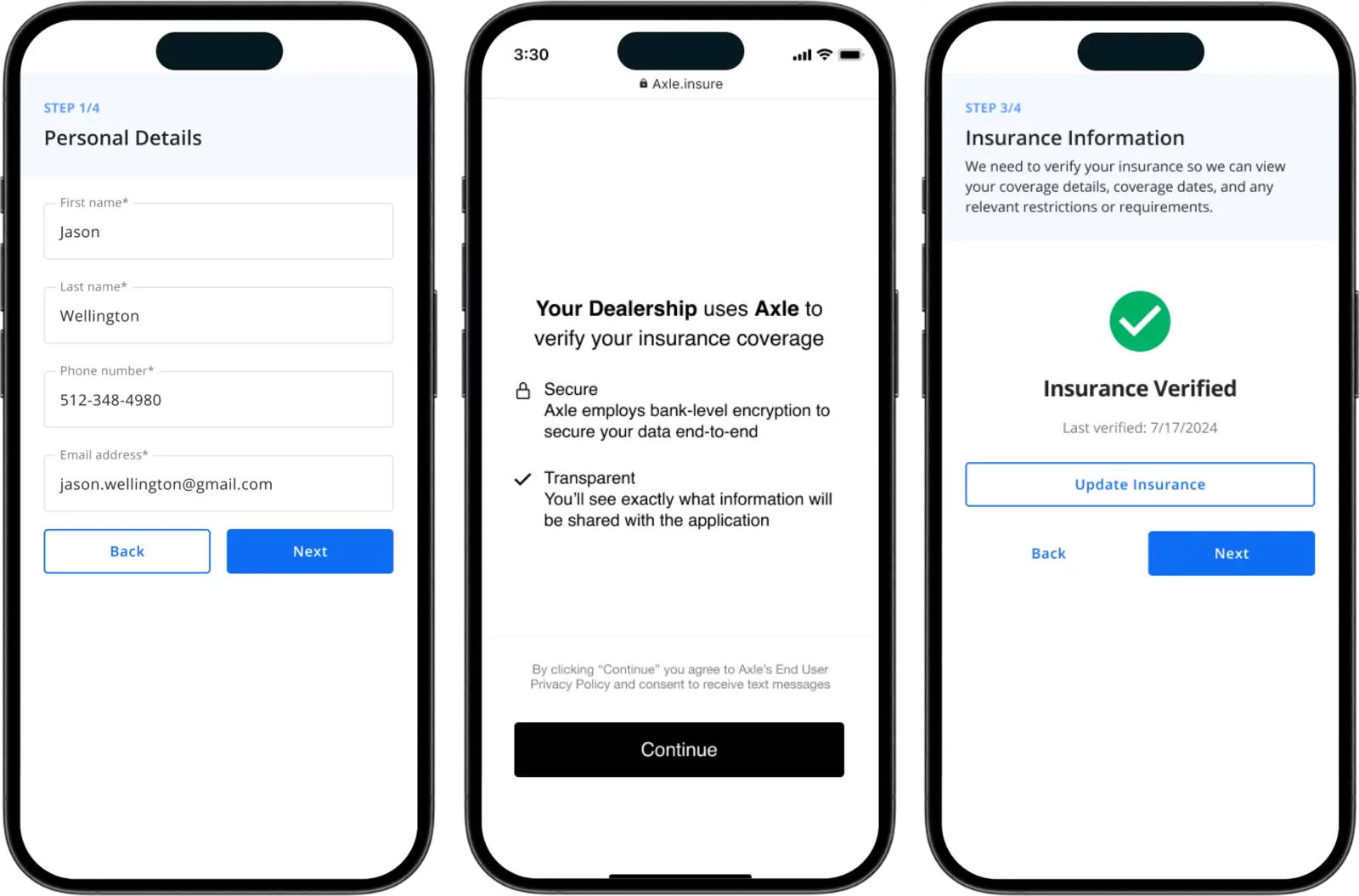

First, the traditional way: More new- and used-car purchases mean those drivers are likely to return to the dealership for their first few service appointments. More people driving in general also means service needs that fell off during the pandemic will pick back up as commuters get back to work. In both cases, dealerships might capture and retain a higher share of service business by investing in the customer experience. Gone are the days where waiting room amenities are important: people want digital interactions with their service advisor and loaner vehicles to keep them moving.

There’s a non-traditional path to profit, too: For customers who need a more flexible option, offering daily rentals can help dealerships generate additional revenue from fleet vehicles. Similarly, giving customers a “bridge” option between vehicle leases can help dealers stretch the monthly revenue from a lessee and hopefully retain their business for the next lease. Both of these strategies cater to a real and growing demand for flexible access over ownership: 38% of all drivers agreed that transportation is necessary, but ownership is not. For younger generations, it’s closer to a full 50% who don’t see car ownership as necessary.

Due to high demand, Dealerships are now dictating the price of the vehicles purchased and profits are soaring. For the next several years, demand for purchases and the need to service owned cars will sustain traditional revenue-generating efforts. However, dealerships should also start exploring more flexible relationships with customers who may want the freedom of vehicle access without the responsibility of ownership.