In their report on dealerships’ responses to COVID-19, Automotive News highlighted that dealerships expect to lean more heavily on service departments for profit, and might carefully try new tactics to generate that profit.

To keep service revenues up, dealerships who responded to AutoNews’ March survey were considering how new discounts and new service offerings could prevent consumers from deferring maintenance needs while they, too, weather the pandemic.

Pickup and delivery looked to be an early lifeline for service departments “80 percent said they were likely to offer expanded or free pick-up and drop-off for repair and maintenance services,” AutoNews reported.

This aligns with our own data on pickup and delivery services. During recent webinars, we polled about 400 dealership and OEM representatives on their previous, current and future plans for pickup and delivery offerings. Almost half of respondents said they were performing pickups and deliveries for 50% or more of their service appointments during the pandemic. You can find more information on the results of our informal polling here.

Like fixed ops, sales departments are experimenting with new ways to interact with customers. Even during the first weeks following nationwide stay-at-home orders, 88% of respondents to the AutoNews survey said they were likely to increase use of digital tools.

Those efforts have been highly visible in the six weeks since AutoNews’ questionnaire went out. Industry reports, social media anecdotes and dealership advertisements all show the big result: online sales and home delivery are spreading rapidly, and customers love it.

For an excellent commentary on that digital shift, read AutoNews’ reporter Lindsay Vanhulle’s column, “Post-pandemic digital shift could include selling cars from home“

In that column, she sums up the change nicely: “Brick-and-mortar dealerships aren’t going away. But this is one more opportunity to try out new ways of selling cars.”

Like Vanhulle, we see opportunity amidst hardship. Now is a great time to experiment with new, digitally-supported fleet uses like at-home test drives, extended loaner terms or lease bridges.

Courtesy vehicles can be put to work in all three of these cases. In fact, we already helped one customer add vehicles from their owned inventory to their Dealerware fleet in order to offer extended loaner contracts to doctors and nurses on the front line of COVID-19.

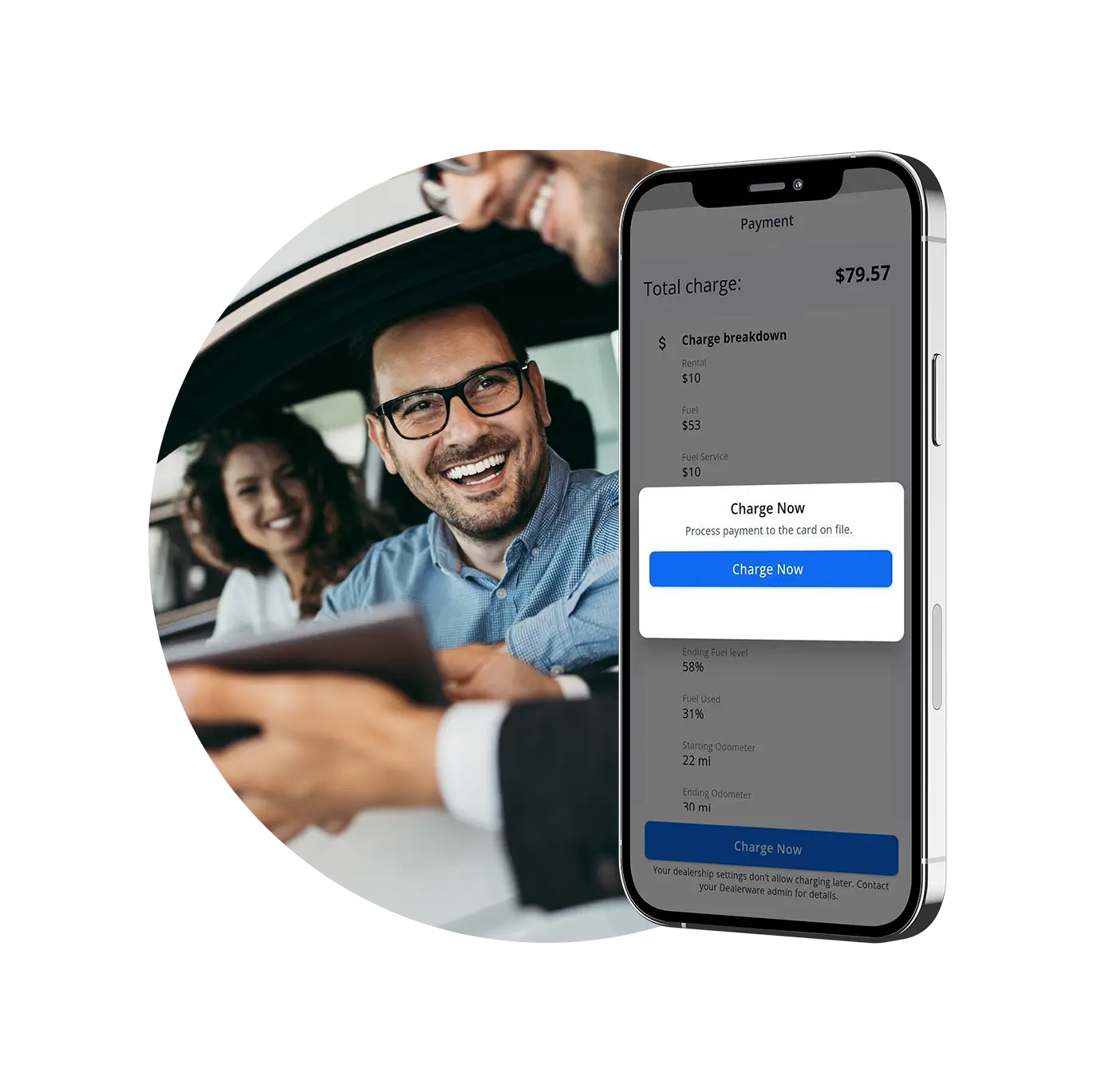

The specifics of insurance and customer fees depend on each dealership’s particular garage insurance policy and courtesy vehicle fleet. But, if new fleet use cases can work within those legal frameworks, fleet management platforms like Dealerware can help dealers closely track costs associated with new fleet programs and even add fees (where appropriate) to help generate cash flow.

Unfortunately, most respondents (67%) to AutoNews’ survey indicated they’re not interested in experimenting with new cash flow generators, despite their expectation that “business as usual” won’t return for six to 12 months.

That’s a long time to wait. And though dealers who use their fleet vehicles and inventories in new ways will not miraculously recover all lost revenue, they will be better equipped to serve customers with new shopping habits and expectations for retail experiences.

If you’re ready to experiment with your fleet, Dealerware is ready to help. Right now we’re offering 60 days free on the Dealerware platform. We’ll help you get set up fast, and there’s no obligation to sign up after the trial period.