Two key indicators to look at when analyzing the performance of your fleet are cost recovery and utilization.

The Dealerware platform is filled with features to help you optimize your fleet’s performance and provides the flexibility to configure unique settings that work for your dealership.

Let’s explore some of the best practices recommended by a Dealerware expert, as well as creative ways our customers use the platform.

Three tools to increase utilization

Alexis Cisneros, Customer Success Manager at Dealerware, recommends three features on the dashboard that have proven to be helpful with utilization: The Fleet Map, Vehicles Not Under Contract, and the Vehicle Utilization Report.

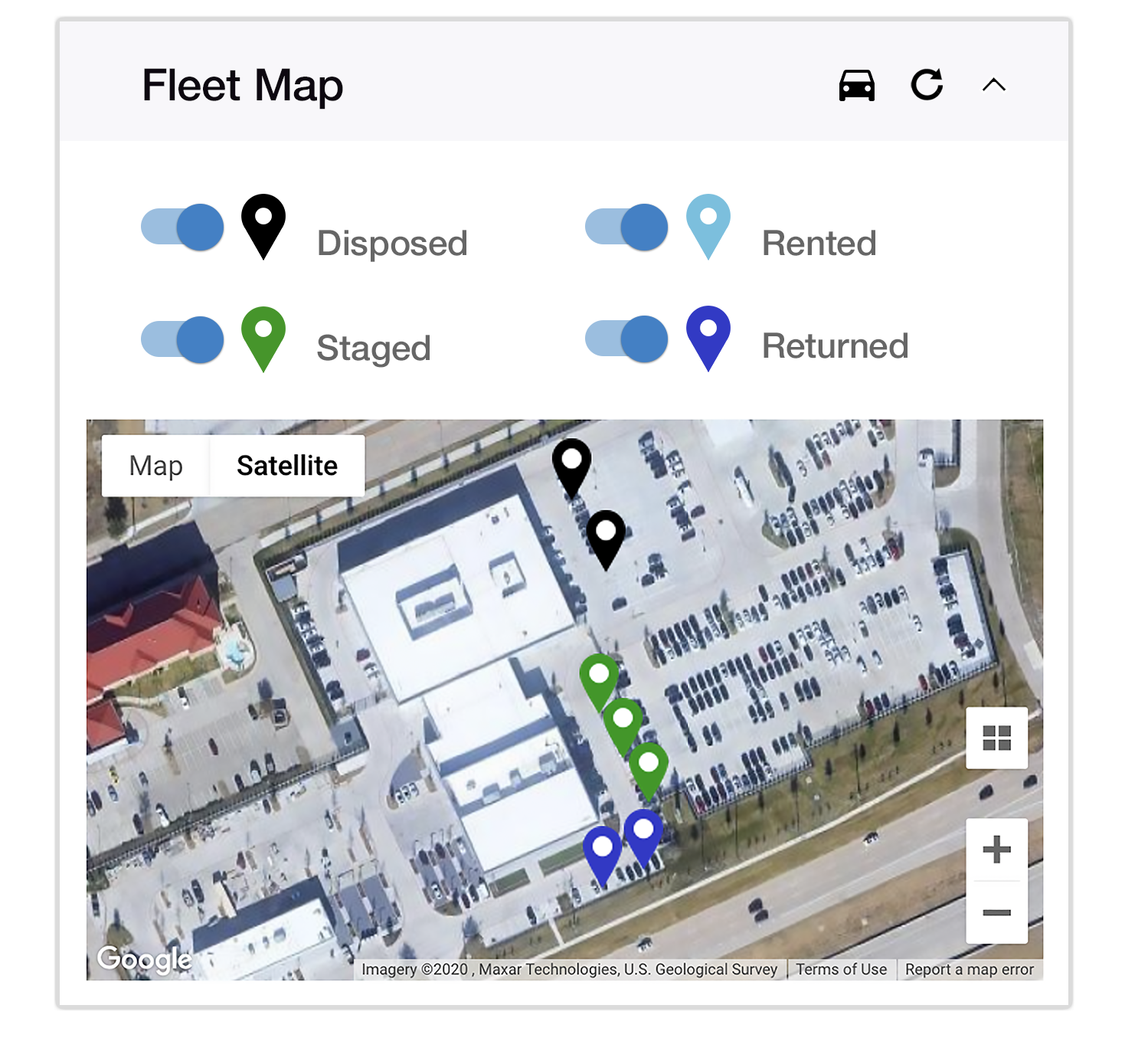

The Fleet Map is centered on your dealership’s address and helps you locate each vehicle by status.

“One way to improve utilization is just by seeing how many Rented vehicles are actually on your lot,” says Cisneros.

Seeing Rented vehicles on your lot indicates that the vehicles have been returned but contracts haven’t been closed. Service advisors need to select “finish contract” in Dealerware Mobile to close a rental contract.

Every moment those vehicles sit on your lot in a Rented status they are increasing your Length of Loan and inaccurately reporting what vehicles are available.

If a vehicle is on your lot and does not require maintenance, it should be in a Returned, In-Prep, or Staged status, not in a Rented status

Cisneros recommends dealerships use the Fleet Map trick to make sure every contract has been finished when opening up the shop, in the middle of the day, and before heading out at the end of the day.

The second tool Cisneros recommends is the Vehicles Not Under Contract section on the Dealerware dashboard.

After ensuring that every vehicle on your lot is in its accurate status with the Fleet Map trick “I would come in every morning and prioritize every single car that was in an available status and had high days off-contract,” she says. Sort the Days Off Contract column in descending order on the dashboard to see which cars have the highest days off-contract.

Determining which cars need to be rented out first ensures available vehicles are not sitting on your lot for extended periods of time, negatively impacting your utilization rates.

Be sure to properly communicate with your Service Advisors which vehicles need to go out as you move down the list.

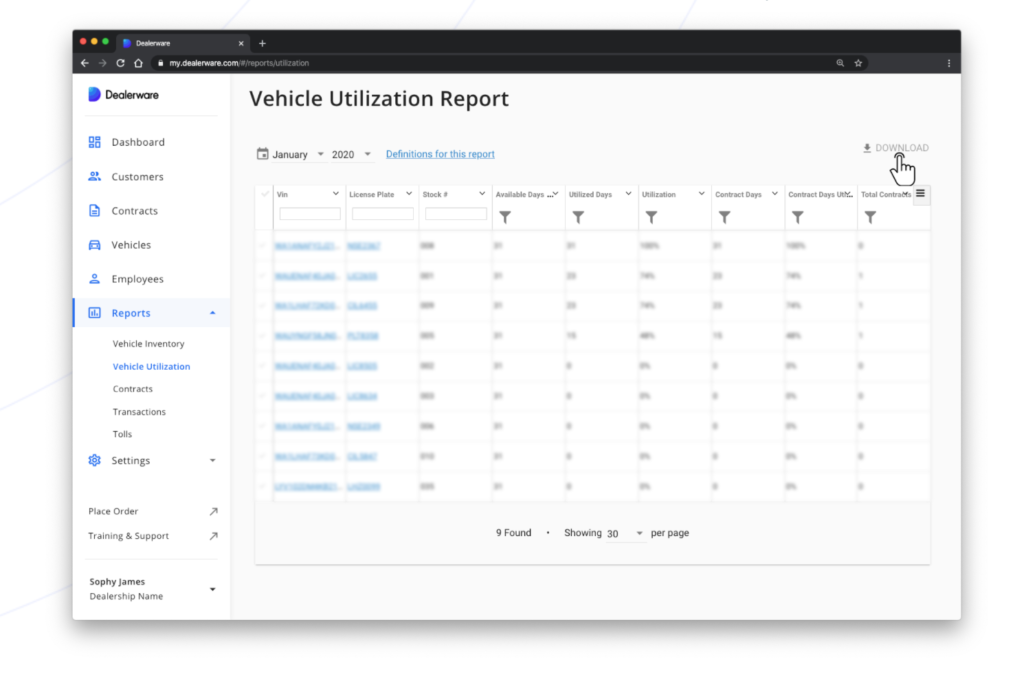

Lastly, the Vehicle Utilization report is a report that breaks down utilization rates at the VIN level based on how many days each vehicle was utilized or available in a calendar month.

A common problem Cisneros sees at dealerships is that certain vehicles are over-utilized while others have low utilization rates.

If you have the same car on the road every single day of the month, while other loaners sit on the lot, you’re sending that vehicle to its premature loaner grave.

A way to combat the early disposal of a vehicle is to keep a close watch on uneven utilization rates across your fleet.

With this data, you can spread, as Cisneros calls it, “the utilization love” evenly across your entire fleet.

Creative ways to recover costs

Dealerships that maximize our software with Connected Car Solutions and Toll Management Solutions see high-cost recovery rates.

CCS reads the fuel consumption of a vehicle under contract and automatically recovers that cost when the contract is closed.

The same goes for tolls; any toll charges incurred while the vehicle is out with a customer are automatically charged to the customer.

With these systems in place, there is no need to manually track costs or to chase down customers for additional payments after contracts are closed.

“That’s the beautiful thing about Dealerware, it’s very set it and forget it,” says Cisneros.

Also, we naturally see high-cost recovery in dealerships with high volumes of repair orders as well as toll-centric regions such as Texas, California, and Florida.

However, “we are finding that there has been a lot of creativity in markets that we were not expecting such as [in] Arizona,” says Cisneros.

This creativity is budding through the Per Contract Fee tool in Cost Recovery Settings on the Dealerware Web.

Dealerships can configure this fee for a variety of reasons customizable to their needs; for example, a $10 “administrative fee” or a $20 “Glass and Gas” fee every time a contract is started.

This fee may seem to blur the line between courtesy vehicles and daily rentals, however, this setting is based on the contract itself vs. the length of time the vehicle is loaned out — it’s not a per-day charge, just a one-time fee.

Dealerships that are not offering daily rentals are using this setting as a flat fee to recover any costs incurred, such as glass damage, tire blowouts, or fuel consumption, while the loaner vehicle is out with a customer under contract.

A dealership in the aforementioned Arizona is recovering, “$30,000 a year just based on the volume of per-contract fees,” says Cisneros.

This low flat fee seems agreeable to customers, knowing that the dealership will handle certain costs incurred while they drive the vehicle.

Nevertheless, proper communication regarding dealership policies throughout the customer lifecycle is important.

Effective communication starts when the appointment is set through a business development center, continues when the customer is toggling the contract agreement summary, and is brought home when the customer returns the vehicle and the contract is closed.

“There should be three points of contact or communication where the driver is told [of these policies],” says Cisneros.

This will help you avoid customers calling back after a surprise charge on their credit card.

In addition to leveraging tools on the Dealerware platform and configuring settings to meet your dealership’s needs, effective communication with your customers will keep customer satisfaction high and keep them coming back to your dealership for service.