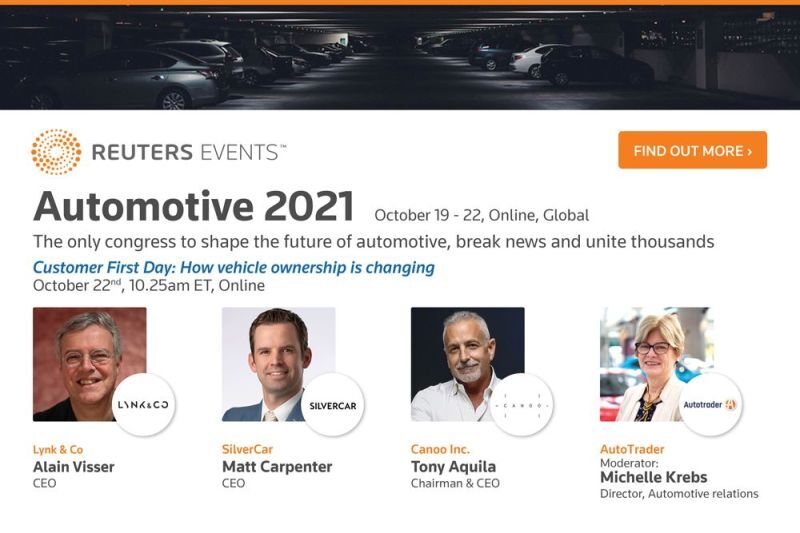

In late October 2021, the Reuters Automotive Summit Panel hosted three leading automotive industry CEOs to discuss how vehicle ownership is changing and what new business models OEMs are creating to attract new customers. Michelle Krebs from Cox Automotive led a discussion asking panelists about the trends and technologies driving this change, and how automotive brands can make the most of new opportunities

Tony Aquila, CEO at Canoo, Alain Visser, CEO at Lynk & Co, and Dealerware CEO own Matt Carpenter each shared remarks on how they see the automotive industry evolving in the future.

Technology adoption at OEMs is key to selling in new models

As investor, CEO, and Chairman of Canoo Tony Aquila oversees the company’s mission to build vehicles for everyone and to be a part of a new generation of vehicle engineering.

Tony attributes the decisions driving consumer changes to the economics happening at the household level.

Reuters Automotive Summit panel

He uses the example of a household torn between traditional vehicle ownership and a flexible membership option as they augment their mobility needs.

“At the end of the day,” he says about the choice to purchase a car or seek alternative ownership models, “it’s a household decision.”

Canoo has developed three different business models to meet the changing needs of consumers.

Consumers probably won’t look to one brand for mobility ‘products’

Alain Visser has spent his entire career in the automotive industry and noticed that since the start that change to the industry’s basic business model is lagging, too.

“The world is changing radically and this industry isn’t,” he said.

As an industry disrupter, Alain started Lynk & Co based on customer insight, “we see a growing importance of experience over ownership.”

Consumers are starting to question whether owning a vehicle makes sense. Vehicles are infamously a depreciating and inefficient asset, “the average car on the planet is used for 4% of the time,” Visser said What’s really important is vehicle utilization.

Lynk & Co’s business model focuses on customer experience over ownership and includes flexible, all-inclusive, month-to-month membership contracts, the option to share your vehicle, and in turn, reduce its monthly cost.

Alain views technology as the start of this new customer benefit but assures that what matters to consumers is the service and experience provided.

Given that, “technology at the end of the day is going to be shared across all car brands.”

Looking ahead, Alain anticipates 80% of the population will use autonomous car-sharing apps to meet their mobility needs, and mobility will be viewed as a service and not a product.

OEMs and dealers can capitalize on today’s lack of mobility choices.

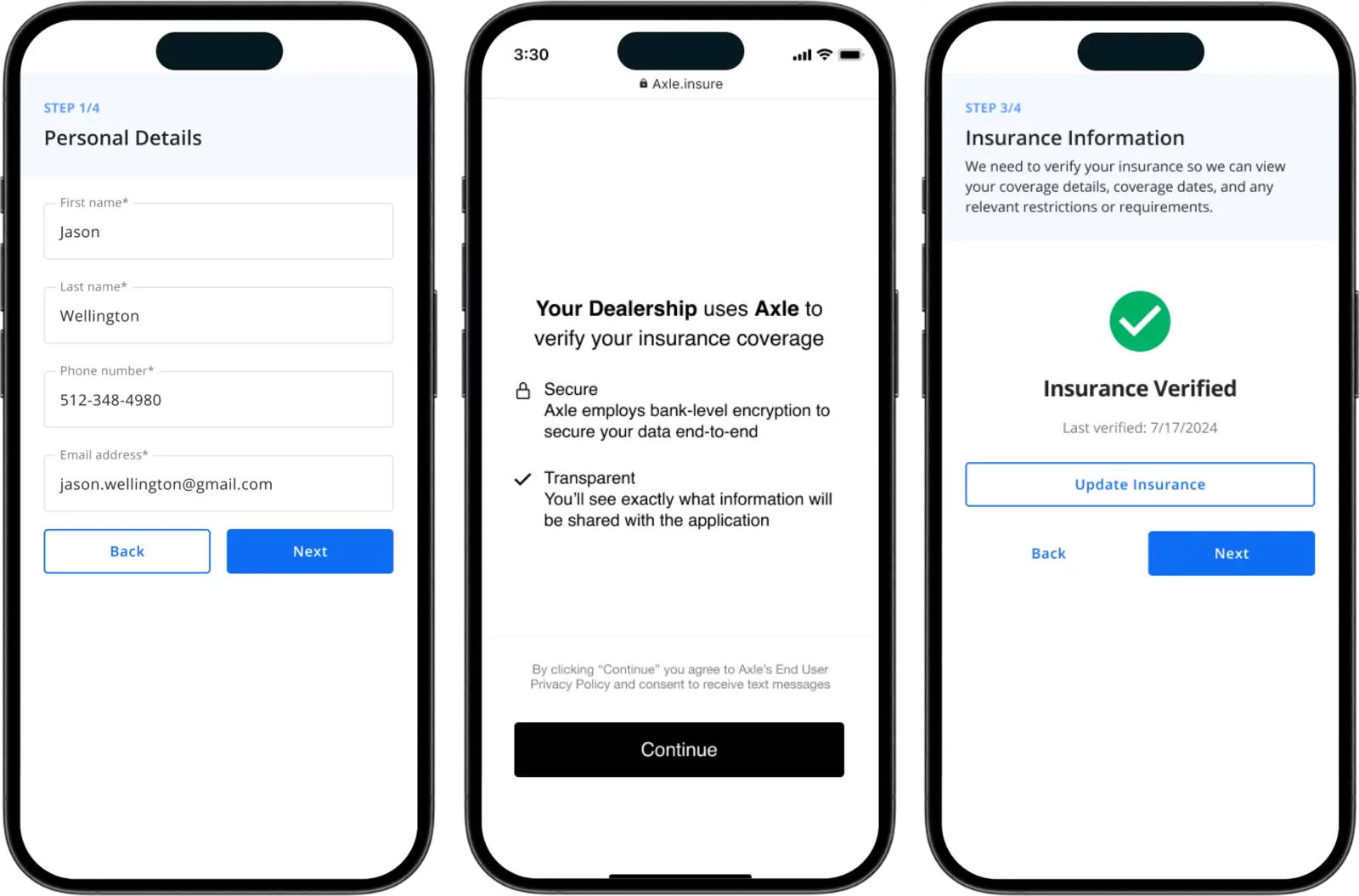

Matt Carpenter, CEO of Dealerware, a cloud-based connected car platform, and Silvercar by Audi, a B2C app-based car rental service, is focused on scaling the technology of these two businesses to give dealership networks profitable mobility models that meet a rapidly-growing consumer need.

Matt agrees on all of the basics: there is consumer friction in the household, cars are expensive, and they depreciate fast. But households have little choice but to commit to long-term ownership models.

He points to these inefficiencies and changes in consumer behavior as the driving force towards the more flexible ownership alternatives consumers desire.

Matt is eager to position Dealerware and Silvercar as a solution to this friction by creating flexible access to a shared pool of vehicles.

While traditional ownership may continue to be the main mode of personal mobility, he says, “a lot of households will be put in the position to condense down from two cars to one” and shared mobility will be used as “an additive feature to vehicle ownership”.

Modern customer-centric experiences are made possible with connected car technology and allow these programs to scale.

When looking forward, Matt anticipates rapid change coming from shared mobility, electric vehicles, and autonomous driving, but believes that optionality and customer choice based on their needs is key.

Overall, the panelists shared a common understanding of the basic frictions consumers face. They agreed that creating more flexible options as an alternative to traditional vehicle ownership is the solution.

The interpretation of what those options are is where they break away to create the future of the automotive industry.